Certified Financial Planner - CFP -

CERTIFIED FINANCIAL PLANNER or CFP certification is the benchmark for global excellence in financial planning. In 26 countries and territories around the world, financial advisers seeking to establish themselves as qualified, competent and ethical financial planners are choosing financial planning’s marks of professional distinction – CFP, CERTIFIED FINANCIAL PLANNER.

Nearly 190,000 CERTIFIED FINANCIAL PLANNER professionals worldwide have met rigorous competency, ethics and practice standards and CFP certification requirements, qualifying them to develop financial planning strategies that assist clients in achieving their financial and life goals.

Structure

- FPSB - Investment Planning Specialist

- FPSB – Retirement and Tax Planning Specialist

- FPSB – Risk and Estate Planning Specialist

- FPSB – CFP

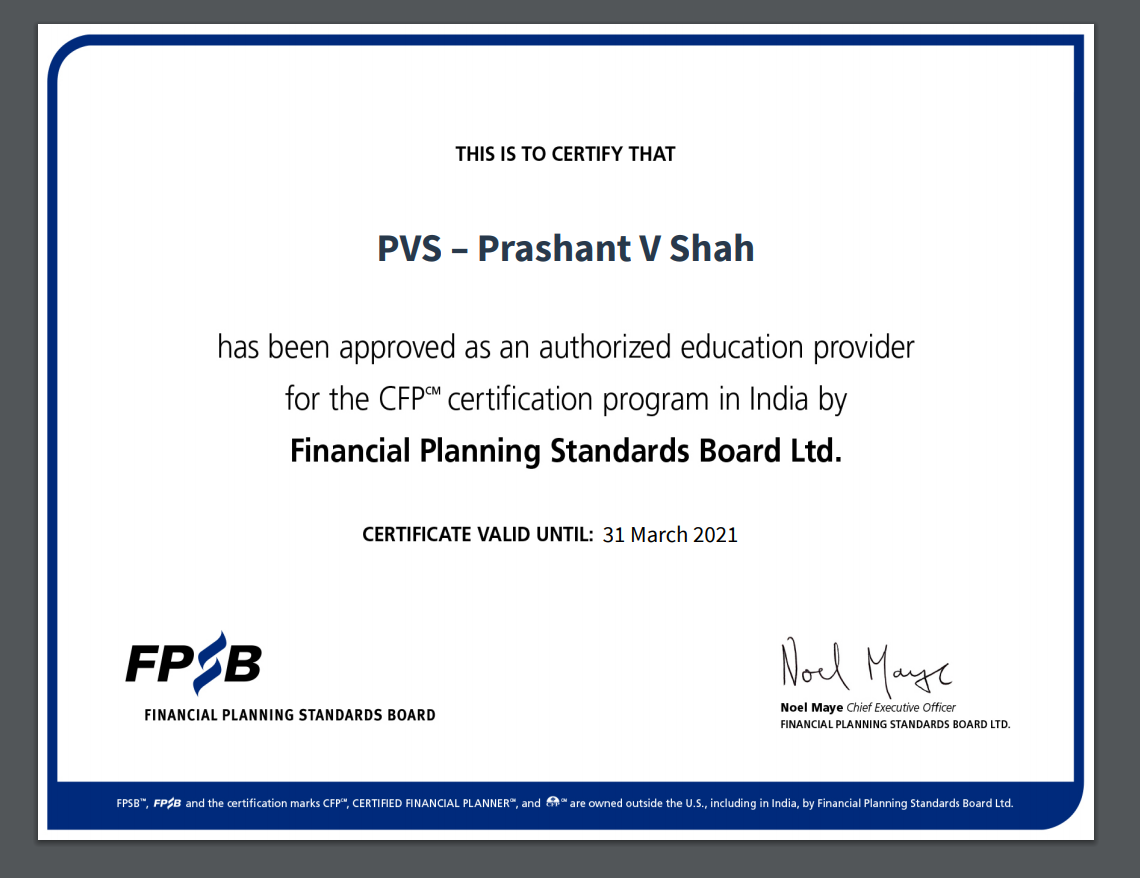

1000+ candidates trained. 13+ years of experience in CFP. Gujarat’s only Authorized Education Provider.

Institute website: www.india.fpsb.org.

Authorized Education Provider Page: https://india.fpsb.org/education-providers/.